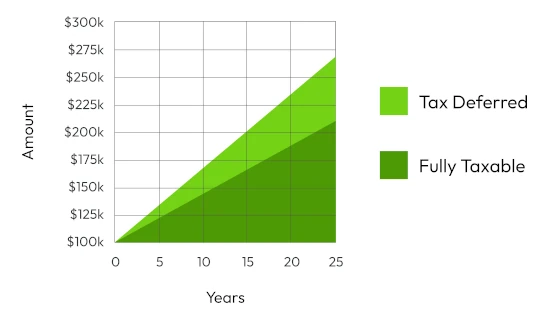

Unlike many other financial tools, annuities grow without being taxed until you withdraw funds. This allows your money to accumulate faster via compound interest without immediate taxation.

Boost Your Retirement Savings

With annuities, you only pay taxes on earnings when you withdraw money, typically during retirement. Until then, your earned interest compounds tax-free, growing faster than many other financial tools.

This means your money stays invested, earning greater potential returns than it would in financial products without tax-deferred growth.

Since you may be in a lower tax bracket when you withdraw funds from an annuity, you may pay less in taxes than you otherwise would.

Is Tax-Deferred Growth Right for You?

If you want to maximize your long-term savings potential and expect to be in a lower tax bracket when you retire, tax-deferred annuities can be a rewarding complement to your retirement portfolio.

Keep in mind that tax-deferred does not mean tax-free—you’ll still owe taxes on withdrawals.